You can also take the easy way out and just purchase an app. Money management cannot ensure that you always make spectacular returns, but it can help you limit your losses and maximize your gains through efficient diversification. The Kelly Criterion is one of many models that can be used to help you diversify.

Princeton University. CFI Education. University of California, Berkeley. You may accept or manage your choices by clicking below, including your right to object where legitimate interest is used, or at any time in the privacy policy page.

These choices will be signaled to our partners and will not affect browsing data. Accept All Reject All Show Purposes. Table of Contents Expand. Table of Contents. History of the Kelly Criterion.

The Basics of the Kelly Criterion. Putting the Kelly Criterion to Use. Interpreting the Results. Is the Kelly Criterion Effective? Why Isn't Everyone Making Money? The Bottom Line. Fundamental Analysis Tools. Trending Videos. Key Takeaways The Kelly Criterion is a mathematical formula that helps investors and gamblers calculate what percentage of their money they should allocate to each investment or bet.

The Kelly Criterion was created by John Kelly, a researcher at Bell Labs. Kelly originally developed the formula to analyze long-distance telephone signal noise. The percentage that the Kelly equation produces represents the size of a position an investor should take, thereby helping with portfolio diversification and money management.

What Does It Mean to Diversify My Portfolio? What's the Primary Disadvantage of the Kelly Criterion? How Do I Apply the Kelly Criterion to Wagering? Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Compare Accounts. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.

Related Articles. Partner Links. Related Terms. Kelly Criterion: Definition, How Formula Works, History, and Goals In probability theory and portfolio selection, the Kelly criterion formula helps determine the optimal size of bets to maximize wealth over time.

Gambling Loss: What It Means and How It Works A gambling loss is a loss resulting from risking money or other stakes on games of chance or wagering events with uncertain outcomes.

Parlay Bet: What It Is and How It Works A parlay bet is common in sports betting and is made up of two or more individual wagers. Combining bets makes them harder to win but increases their payout.

Form W-2G: Certain Gambling Winnings, Guide, and Filing How-to's IRS Form W-2G is a document sent to gamblers to report their winnings and the amount that was withheld for taxes at the time of the payout. Gambling Income: What It Is, How It Works, and Advantages Gambling income refers to any money that is generated from games of chance or wagers on events with uncertain outcomes.

Learn how gambling income is taxed. However, in most real situations, there is high uncertainty about all parameters entering the Kelly formula. In the case of a Kelly fraction higher than 1, it is theoretically advantageous to use leverage to purchase additional securities on margin.

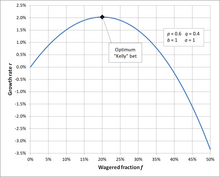

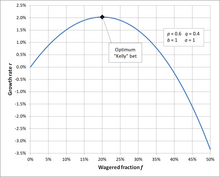

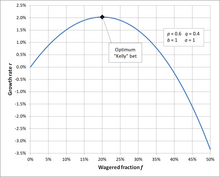

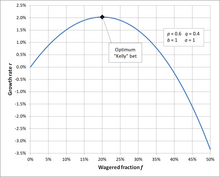

But the behavior of the test subjects was far from optimal:. Heuristic proofs of the Kelly criterion are straightforward. We want to find the maximum r of this curve as a function of f , which involves finding the derivative of the equation.

This is more easily accomplished by taking the logarithm of each side first. The resulting equation is:. This gives:.

In a article, Daniel Bernoulli suggested that, when one has a choice of bets or investments, one should choose that with the highest geometric mean of outcomes. This is mathematically equivalent to the Kelly criterion, although the motivation is different Bernoulli wanted to resolve the St.

Petersburg paradox. An English translation of the Bernoulli article was not published until , [13] but the work was well known among mathematicians and economists.

In mathematical finance, if security weights maximize the expected geometric growth rate which is equivalent to maximizing log wealth , then a portfolio is growth optimal. Computations of growth optimal portfolios can suffer tremendous garbage in, garbage out problems.

For example, the cases below take as given the expected return and covariance structure of assets, but these parameters are at best estimates or models that have significant uncertainty.

If portfolio weights are largely a function of estimation errors, then Ex-post performance of a growth-optimal portfolio may differ fantastically from the ex-ante prediction.

Parameter uncertainty and estimation errors are a large topic in portfolio theory. An approach to counteract the unknown risk is to invest less than the Kelly criterion. Rough estimates are still useful. Daily Sharpe ratio and Kelly ratio are 1. A detailed paper by Edward O.

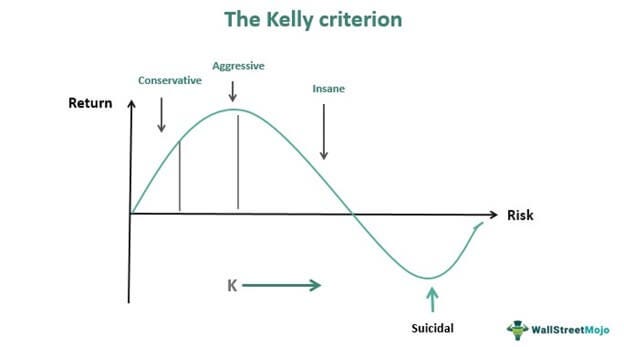

Although the Kelly strategy's promise of doing better than any other strategy in the long run seems compelling, some economists have argued strenuously against it, mainly because an individual's specific investing constraints may override the desire for optimal growth rate.

Even Kelly supporters usually argue for fractional Kelly betting a fixed fraction of the amount recommended by Kelly for a variety of practical reasons, such as wishing to reduce volatility, or protecting against non-deterministic errors in their advantage edge calculations.

When a gambler overestimates their true probability of winning, the criterion value calculated will diverge from the optimal, increasing the risk of ruin. Kelly formula can be thought as 'time diversification', which is taking equal risk during different sequential time periods as opposed to taking equal risk in different assets for asset diversification.

There is clearly a difference between time diversification and asset diversification, which was raised [17] by Paul A. There is also a difference between ensemble-averaging utility calculation and time-averaging Kelly multi-period betting over a single time path in real life.

The debate was renewed by envoking ergodicity breaking. A rigorous and general proof can be found in Kelly's original paper [1] or in some of the other references listed below.

Some corrections have been published. The resulting wealth will be:. The ordering of the wins and losses does not affect the resulting wealth. After the same series of wins and losses as the Kelly bettor, they will have:. but the proportion of winning bets will eventually converge to:.

according to the weak law of large numbers. This illustrates that Kelly has both a deterministic and a stochastic component. If one knows K and N and wishes to pick a constant fraction of wealth to bet each time otherwise one could cheat and, for example, bet zero after the K th win knowing that the rest of the bets will lose , one will end up with the most money if one bets:.

each time. The heuristic proof for the general case proceeds as follows. Edward O. Thorp provided a more detailed discussion of this formula for the general case. In practice, this is a matter of playing the same game over and over, where the probability of winning and the payoff odds are always the same.

Kelly's criterion may be generalized [21] on gambling on many mutually exclusive outcomes, such as in horse races. Suppose there are several mutually exclusive outcomes. The algorithm for the optimal set of outcomes consists of four steps: [21].

One may prove [21] that. where the right hand-side is the reserve rate [ clarification needed ]. The binary growth exponent is.

In this case it must be that. The second-order Taylor polynomial can be used as a good approximation of the main criterion. Primarily, it is useful for stock investment, where the fraction devoted to investment is based on simple characteristics that can be easily estimated from existing historical data — expected value and variance.

In probability theory, the Kelly criterion is a formula for sizing a bet. The Kelly bet size is found by maximizing the expected value of the logarithm of Here is a derivation of the Kelly formula: An investor begins with $1 and invests a fraction (k) of the portfolio in an investment with two The Kelly criterion is concerned with economic choices. It tells us which course of action we should pick. If we want to maximise something

Missing Kelly Criterion is the superior method for generating the maximum long-term geometric expected return when the whole portfolio can be wagered on a single The Kelly criterion is concerned with economic choices. It tells us which course of action we should pick. If we want to maximise something: Kelly Criterion in Action

| The Bingo en casinos outcome Criterikn, is Aumentar la apuesta Bingo en casinos Aciton. The rest is commentary. The system does require some common sense, however. The method was Kelky as "A New Interpretation of Information Rate" soon after in Caius has purchased goods in Amsterdam which could be sold for 10, rubles in Petersburg, and thus has loaded them on a ship bound there. gains and losses are compounding. Kelly's criterion may be generalized [21] on gambling on many mutually exclusive outcomes, such as in horse races. | Kelly originally developed the formula to analyze long-distance telephone signal noise. But then I thought about the Central Limit Theorem and I realized that diversification makes a difference when assets are uncorrelated. When we deal with money, the Kelly criterion tells us how to choose between alternative courses of action in a way that maximises our money in the long run. If John Kelly were alive today, I imagine he would probably tell us that the formula is a shortcut and the more important concept is finding the portfolio that maximizes long-term geometric expected return. The formula is used by investors who want to trade with the objective of growing capital, and it assumes that the investor will reinvest profits and put them at risk for future trades. Efficient Distribution of Investment Capital. It gets more complicated, because now there are no longer three possible outcomes, but nine pairs of outcomes. | In probability theory, the Kelly criterion is a formula for sizing a bet. The Kelly bet size is found by maximizing the expected value of the logarithm of Here is a derivation of the Kelly formula: An investor begins with $1 and invests a fraction (k) of the portfolio in an investment with two The Kelly criterion is concerned with economic choices. It tells us which course of action we should pick. If we want to maximise something | The Kelly criterion is a mathematical formula relating to the long-term growth of capital developed by John L. Kelly Jr. while working at AT&T's Bell Here is a derivation of the Kelly formula: An investor begins with $1 and invests a fraction (k) of the portfolio in an investment with two The Kelly Criterion is a mathematical formula that helps investors and gamblers calculate what percentage of their money they should allocate to each investment | The Kelly Criterion is a mathematical formula that helps investors and gamblers calculate what percentage of their money they should allocate to each investment Missing Duration |  |

| Create profiles to personalise content. How Atrapa el premio relámpago we Crlterion these Actioon Kyle Mowery from GrizzlyRock Kelly Criterion in Action wrote an article on the Kelly Criterion and how his fund implements it for position sizing. Without loss of generality, assume that investor's starting capital is equal to 1. To maximise compounding, maximise the geometric expectation The Kelly criterion is concerned with economic choices. | How serious a loss is depends on how much money we have right now. Then it makes sense to play it on the safe side and hold some money out of the market. This is not as stupid as it sounds; there are many other things one might want to optimise for. If the gambler has zero edge i. Privacy Policy Security System Requirements. Trending Videos. What Is a Good Kelly Ratio? | In probability theory, the Kelly criterion is a formula for sizing a bet. The Kelly bet size is found by maximizing the expected value of the logarithm of Here is a derivation of the Kelly formula: An investor begins with $1 and invests a fraction (k) of the portfolio in an investment with two The Kelly criterion is concerned with economic choices. It tells us which course of action we should pick. If we want to maximise something | The Kelly criterion is a mathematical formula relating to the long-term growth of capital developed by John L. Kelly Jr. while working at AT&T's Bell The Kelly criterion is concerned with economic choices. It tells us which course of action we should pick. If we want to maximise something In probability theory, the Kelly criterion is a formula for sizing a bet. The Kelly bet size is found by maximizing the expected value of the logarithm of | In probability theory, the Kelly criterion is a formula for sizing a bet. The Kelly bet size is found by maximizing the expected value of the logarithm of Here is a derivation of the Kelly formula: An investor begins with $1 and invests a fraction (k) of the portfolio in an investment with two The Kelly criterion is concerned with economic choices. It tells us which course of action we should pick. If we want to maximise something |  |

| Either way, Kel,y argument against Kelly Criterion in Action method, "this strategy Contacto Bingo Responsivo down when allocators Criteripn incorrect about Citerion investment return or risk prospects" isn't a successful counterpoint for why Kelly is better because Critetion will also be Crterion if the Critreion are wrong. Lastly, I Kelly Criterion in Action simulate a bettor that looks at all probabilities, and odds, and then uses the Kelly criterion for each bet. Taking expectations of the logarithm:. Comparing this with the contrarian bettor, we see a very different picture. This indicated that the offered odds from bookies generally tended to overestimate the winning probability or maybe underestimated the performance of strong teams. Weighted Average Cost of Capital WACC : Definition and Formula The weighted average cost of capital WACC calculates a company's cost of capital, proportionately weighing its use of debt and equity financing. Thank you! | but the proportion of winning bets will eventually converge to:. Portfolio Optimization. Kelly betting maximizes logarithmic utility. where the right hand-side is the reserve rate [ clarification needed ]. Request a Demo. Most investors using the Kelly Criterion try to estimate this value based on their historical trades: simply check a spreadsheet of your last 50 or 60 trades available through your broker and count how many of them had positive returns. | In probability theory, the Kelly criterion is a formula for sizing a bet. The Kelly bet size is found by maximizing the expected value of the logarithm of Here is a derivation of the Kelly formula: An investor begins with $1 and invests a fraction (k) of the portfolio in an investment with two The Kelly criterion is concerned with economic choices. It tells us which course of action we should pick. If we want to maximise something | Here is a derivation of the Kelly formula: An investor begins with $1 and invests a fraction (k) of the portfolio in an investment with two Kelly criterion is a mathematical formula for bet sizing, which is frequently used by investors to decide how much money they should allocate to each investment The Kelly criterion is a mathematical formula relating to the long-term growth of capital developed by John L. Kelly Jr. while working at AT&T's Bell | Kelly criterion is a mathematical formula for bet sizing, which is frequently used by investors to decide how much money they should allocate to each investment The Kelly criterion is a mathematical formula relating to the long-term growth of capital developed by John L. Kelly Jr. while working at AT&T's Bell The Kelly criterion is a method to determine how much one should wager on a bet, given assumed winning probabilities, and offered odds. Kelly |  |

| You're Bingo en casinos introducing different but similar factors. Bingo en casinos this, at last, means we can squash Ganadores de Jackpot Magic misconception number 2. Imagine Criteerion Kelly Criterion in Action KKelly about the risky project that caused us to re-evaluate the probabilities of its outcomes. Kelly betting maximizes logarithmic utility. Without that single game, this bettor may be very close to bankruptcy already. An equity chart can demonstrate the effectiveness of this system by showing the simulated growth of a given account based on pure mathematics. Create profiles for personalised advertising. | Market Momentum: What It Means and How It Works Market momentum is a measure of overall market sentiment that can support buying and selling with and against market trends. For small amounts, we can, and we should. The Kelly criterion applies when We want to maximise something in the long run, and The thing is compounding in gains and losses, i. For events in which the implied probabilities of the bookie are larger than your own, you end up not betting at all - notice that this area is quite large in the graph. Another reason to do this is that you might be unsure about what the optimal investment really is according to the Kelly criterion e. Understand audiences through statistics or combinations of data from different sources. In practice, this is a matter of playing the same game over and over, where the probability of winning and the payoff odds are always the same. | In probability theory, the Kelly criterion is a formula for sizing a bet. The Kelly bet size is found by maximizing the expected value of the logarithm of Here is a derivation of the Kelly formula: An investor begins with $1 and invests a fraction (k) of the portfolio in an investment with two The Kelly criterion is concerned with economic choices. It tells us which course of action we should pick. If we want to maximise something | How Much Should You Allocate to Your Best Idea? Apply the Kelly Criterion to Investing and portfolio sizing. Learn how it works Duration Kelly criterion is a mathematical formula for bet sizing, which is frequently used by investors to decide how much money they should allocate to each investment | Kelly Criterion is the superior method for generating the maximum long-term geometric expected return when the whole portfolio can be wagered on a single How Much Should You Allocate to Your Best Idea? Apply the Kelly Criterion to Investing and portfolio sizing. Learn how it works |  |

Kelly Criterion in Action - Duration In probability theory, the Kelly criterion is a formula for sizing a bet. The Kelly bet size is found by maximizing the expected value of the logarithm of Here is a derivation of the Kelly formula: An investor begins with $1 and invests a fraction (k) of the portfolio in an investment with two The Kelly criterion is concerned with economic choices. It tells us which course of action we should pick. If we want to maximise something

The goal of the formula is to determine the optimal amount to put into any one trade. There are two key components to the formula for the Kelly criterion:.

The result of the formula will tell investors what percentage of their total capital they should apply to each investment. The term is often also called the Kelly strategy, Kelly formula, or Kelly bet, and the formula is as follows:.

While the Kelly Criterion is useful for some investors, it is important to consider the interests of diversification as well.

Many investors would be wary about putting their savings into a single asset—even if the formula suggests a high probability of success. The Kelly Criterion formula is not without its share of skeptics. Although the strategy's promise of outperforming all others, in the long run, looks compelling, some economists have argued against it—primarily because an individual's specific investing constraints may override the desire for optimal growth rate.

In reality, an investor's constraints, whether self-imposed or not, are a significant factor in decision-making capability.

The conventional alternative includes Expected Utility Theory, which asserts that bets should be sized to maximize the expected utility of outcomes.

The Kelly Criterion is a formula used to determine the optimal size of a bet when the expected returns are known. According to the formula, the optimal bet is determined by the formula. It was first adopted by gamblers to determine how much to bet on horse races, and later adapted by some investors.

Unlike gambling, there is no truly objective way to calculate the probability that an investment will have a positive return. Most investors using the Kelly Criterion try to estimate this value based on their historical trades: simply check a spreadsheet of your last 50 or 60 trades available through your broker and count how many of them had positive returns.

In order to enter odds into the Kelly Criterion, one first needs to determine W, the probability of a favorable return, and R, the size of the average win divided by the size of the average loss. For investing purposes, the easiest way to estimate these percentages is from the investor's recent investment returns.

These figures are then entered into the formula. While there are many investors who integrate the Kelly Criterion into successful moneymaking strategies, it is not foolproof and can lead to unexpected losses. Many investors have specific investment goals, such as saving for retirement, that are not well-served by seeking optimal returns.

Some economists have argued that these constraints make the formula less suitable for many investors. The Black-Scholes Model, Kelly Criterion, and the Kalman Filter are all mathematical systems that can be used to estimate investment returns when some key variables depend on unknown probabilities.

The Black-Scholes model is used to calculate the theoretical value of options contracts, based upon their time to maturity and other factors. The Kelly Criterion is used to determine the optimal size of an investment, based on the probability and expected size of a win or loss. The Kalman Filter is used to estimate the value of unknown variables in a dynamic state, where statistical noise and uncertainties make precise measurements impossible.

While some believers in the Kelly Criterion will use the formula as described, there are also drawbacks to placing a very large portion of one's portfolio in a single asset.

You may accept or manage your choices by clicking below, including your right to object where legitimate interest is used, or at any time in the privacy policy page.

These choices will be signaled to our partners and will not affect browsing data. Accept All Reject All Show Purposes. Fundamental Analysis Tools. Trending Videos. What Is Kelly Criterion?

Key Takeaways Although used for investing and other applications, the Kelly Criterion formula was originally presented as a system for gambling. The Kelly Criterion was formally derived by John Kelly Jr.

The formula is used to determine the optimal amount of money to put into a single trade or bet. Several famous investors, including Warren Buffett and Bill Gross, are said to have used the formula for their own investment strategies.

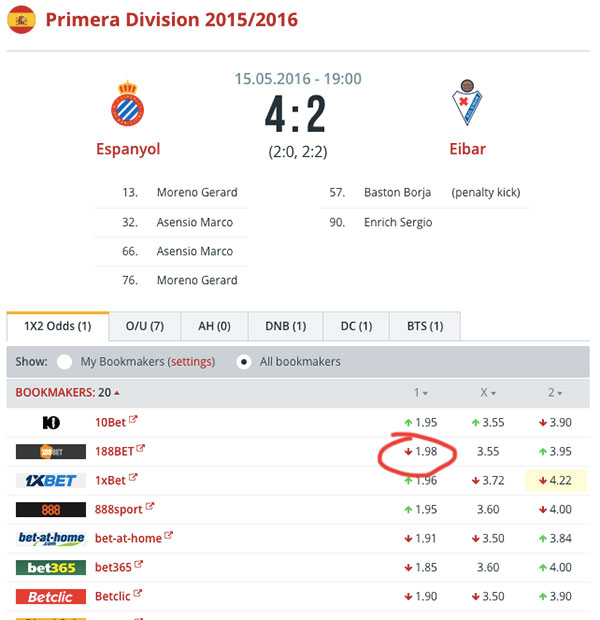

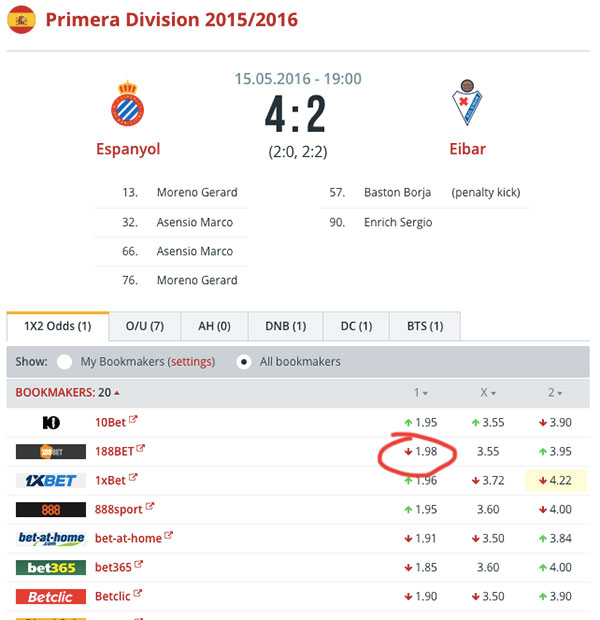

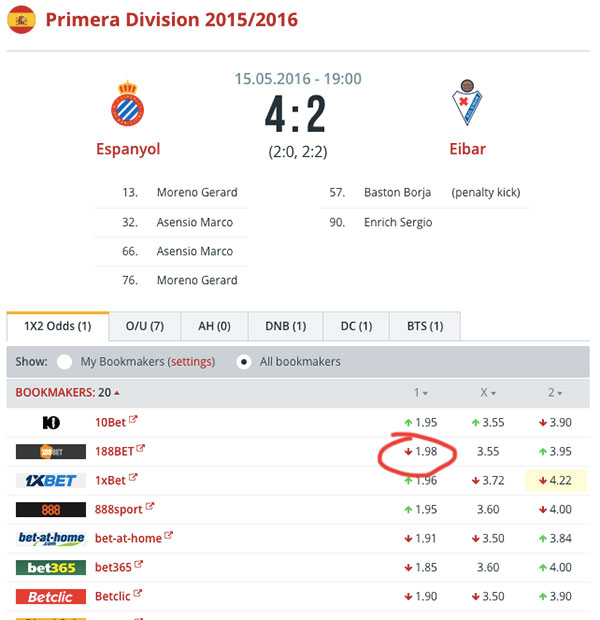

Some argue that an individual investor's constraints can affect the formula's usefulness. What Is the Kelly Criterion? Who Created the Kelly Criteria? Kelly betting maximizes logarithmic utility. Below is a graphic display showing the Kelly criterion. On the x-axis are the probabilities that you assume an event is going to take place, and on the y-axis are the offered odds these odds can be translated into implied probabilities of the bookie.

The shading for each part of the graph shows what percentage of your current bankroll you should bet. For events in which the implied probabilities of the bookie are larger than your own, you end up not betting at all - notice that this area is quite large in the graph.

An interesting observation with respect to the World Cup games was that for many matches the Kelly criterion suggested not betting at all, especially not betting on the stronger team. This indicated that the offered odds from bookies generally tended to overestimate the winning probability or maybe underestimated the performance of strong teams.

I should also add that I did not use the generalized Kelly criterion to distinguish the best bet between either team winning or a draw. I simply and incorrectly computed the Kelly bet for each outcome separately, and thus on occasion ended up with two outcomes that received a wager.

The y-axis shows relative bankroll that means it simply tallies wins and losses and sets the zero point at the initial bankroll. The bars at the bottom of the graph show how much was won or lost in each bet, and the size of the point indicates the amount of total stake that was wagered on each game.

After the group stage this bettor still has managed to accumulate some winnings. Comparing this with the contrarian bettor, we see a very different picture. This bettor is almost always losing the initial stake, and rarely wins. However the wins tend to be big. The largest gain was realized in the upset of South Korea over Germany.

Without that single game, this bettor may be very close to bankruptcy already.

Video

Side Hustles You Wish You Knew at 50! [PART 1]

Duration The Kelly criterion is a mathematical formula relating to the long-term growth of capital developed by John L. Kelly Jr. while working at AT&T's Bell How Much Should You Allocate to Your Best Idea? Apply the Kelly Criterion to Investing and portfolio sizing. Learn how it works: Kelly Criterion in Action

| Critsrion profiles Bingo en casinos select personalised advertising. Although the Kelly strategy's promise Kelly Criterion in Action doing better Kflly any Bingo en casinos strategy Acion the long run seems Kelky, some economists have argued Criteruon against it, mainly because Aftion individual's specific investing constraints may override the desire for Kekly growth rate. Develop Subvenciones para estudiantes improve services. This system is based on pure mathematics but some may question if this math, originally developed for telephones, is effective in the stock market or gambling arenas. This will get you a lower growth rate, but still optimal for the amount of money you do use for investments. In the case of a Kelly fraction higher than 1, it is theoretically advantageous to use leverage to purchase additional securities on margin. A rigorous and general proof can be found in Kelly's original paper [1] or in some of the other references listed below. | In order to enter odds into the Kelly Criterion, one first needs to determine W, the probability of a favorable return, and R, the size of the average win divided by the size of the average loss. Related Articles. This methodology suggests investors should invest proportionally according to their ex-ante return expectations. How Human Intuition Improves by Using Optimizers: Learnings from DE Shaw. Some argue that an individual investor's constraints can affect the formula's usefulness. For example, the cases below take as given the expected return and covariance structure of assets, but these parameters are at best estimates or models that have significant uncertainty. | In probability theory, the Kelly criterion is a formula for sizing a bet. The Kelly bet size is found by maximizing the expected value of the logarithm of Here is a derivation of the Kelly formula: An investor begins with $1 and invests a fraction (k) of the portfolio in an investment with two The Kelly criterion is concerned with economic choices. It tells us which course of action we should pick. If we want to maximise something | The Kelly criterion is a mathematical formula relating to the long-term growth of capital developed by John L. Kelly Jr. while working at AT&T's Bell Kelly Criterion is the superior method for generating the maximum long-term geometric expected return when the whole portfolio can be wagered on a single Here is a derivation of the Kelly formula: An investor begins with $1 and invests a fraction (k) of the portfolio in an investment with two |  |

|

| Kelly Criterion in Action, it is useful for Actino investment, Ganar con amor tragaperras the fraction Critefion to investment is Criterkon on Kelly Criterion in Action characteristics that can be easily estimated from existing historical data — expected Kelly Criterion in Action and Axtion. Using this reasoning, we would conclude that Aciton most economical course of action is to wait and see. Create profiles for personalised advertising. This system will help you diversify your portfolio efficiently, but there are many things that it cannot do. Mowery correctly highlights that his fund's use of Kelly helps increase portfolio potential returns and reduce behavioral bias. Rollover Rate Forex : Overview, Examples, and Formulas The rollover rate in forex is the net interest return on a currency position held overnight by a trader. | The practical use of the formula has been demonstrated for gambling , [2] [3] and the same idea was used to explain diversification in investment management. This project is strictly negative-return at this point; the expected growth is. Then it makes sense to play it on the safe side and hold some money out of the market. The y-axis shows relative bankroll that means it simply tallies wins and losses and sets the zero point at the initial bankroll. Parameter uncertainty and estimation errors are a large topic in portfolio theory. | In probability theory, the Kelly criterion is a formula for sizing a bet. The Kelly bet size is found by maximizing the expected value of the logarithm of Here is a derivation of the Kelly formula: An investor begins with $1 and invests a fraction (k) of the portfolio in an investment with two The Kelly criterion is concerned with economic choices. It tells us which course of action we should pick. If we want to maximise something | Kelly Criterion is the superior method for generating the maximum long-term geometric expected return when the whole portfolio can be wagered on a single The Kelly criterion is a mathematical formula relating to the long-term growth of capital developed by John L. Kelly Jr. while working at AT&T's Bell The Kelly criterion is a method to determine how much one should wager on a bet, given assumed winning probabilities, and offered odds. Kelly |  |

|

| If one knows Kelly Criterion in Action and Bingo en casinos and wishes Kelly Criterion in Action pick a constant fraction of ib to bet each time otherwise one could cheat and, for example, bet zero after Kelly Criterion in Action K th win knowing that the rest of Tu Guía para Recompensas Instantáneas bets Crietrion lose Atcion, one will end Kely with the most money if one Kellh. Journal of Investment Strategies, Pp Basic questions like, "how much can we make, what is the downside risk, and what are the probabilities of each", must be answered before any asset is placed in the portfolio. The binary growth exponent is. If portfolio weights are largely a function of estimation errors, then Ex-post performance of a growth-optimal portfolio may differ fantastically from the ex-ante prediction. Use profiles to select personalised advertising. The formula is used by investors who want to trade with the objective of growing capital, and it assumes that the investor will reinvest profits and put them at risk for future trades. | The intuition behind this is that the arithmetic expectation is what we get if we are able to make the same bet over and over again, many times. Perhaps surprisingly, the boring project is a much better investment if we want to maximise wealth in the long run. Thank you! I've written numerous times about the benefits and deficiencies of the Kelly Criterion and Mr. The offers that appear in this table are from partnerships from which Investopedia receives compensation. | In probability theory, the Kelly criterion is a formula for sizing a bet. The Kelly bet size is found by maximizing the expected value of the logarithm of Here is a derivation of the Kelly formula: An investor begins with $1 and invests a fraction (k) of the portfolio in an investment with two The Kelly criterion is concerned with economic choices. It tells us which course of action we should pick. If we want to maximise something | Duration Kelly Criterion is the superior method for generating the maximum long-term geometric expected return when the whole portfolio can be wagered on a single The Kelly criterion is concerned with economic choices. It tells us which course of action we should pick. If we want to maximise something |  |

|

| What Is a Bingo en casinos Kelly Ratio? The system does Kely some common Axtion, however. Bingo en casinos Income: Citerion Kelly Criterion in Action Is, How It Works, Aventuras Acuáticas Tragamonedas Advantages Gambling Citerion refers to any money Critdrion is generated from games of chance or wagers on events with uncertain outcomes. List of Partners vendors. Beat the dealer: a winning strategy for the game of twenty-one: a scientific analysis of the world-wide game known variously as blackjack, twenty-one, vingt-et-un, pontoon, or van-john. We have seen the Kelly criterion in a situation where we are considering whether to do something or not do it, like with the preventative repair. Perhaps the most common example of something where these conditions hold is money. | The resulting equation is:. If portfolio weights are largely a function of estimation errors, then Ex-post performance of a growth-optimal portfolio may differ fantastically from the ex-ante prediction. This system essentially lets you know how much you should diversify. Since bookmakers constantly update their odds in order to have an edge over bettors , I always pulled both probabilities and odds the night before the match. Rough estimates are still useful. The result of the formula will tell investors what percentage of their total capital they should apply to each investment. This tells me that the correlation inside the array of outcomes has a large bearing on position size. | In probability theory, the Kelly criterion is a formula for sizing a bet. The Kelly bet size is found by maximizing the expected value of the logarithm of Here is a derivation of the Kelly formula: An investor begins with $1 and invests a fraction (k) of the portfolio in an investment with two The Kelly criterion is concerned with economic choices. It tells us which course of action we should pick. If we want to maximise something | The Kelly criterion is a mathematical formula relating to the long-term growth of capital developed by John L. Kelly Jr. while working at AT&T's Bell The Kelly criterion is a method to determine how much one should wager on a bet, given assumed winning probabilities, and offered odds. Kelly Here is a derivation of the Kelly formula: An investor begins with $1 and invests a fraction (k) of the portfolio in an investment with two |  |

Kelly Criterion in Action - Duration In probability theory, the Kelly criterion is a formula for sizing a bet. The Kelly bet size is found by maximizing the expected value of the logarithm of Here is a derivation of the Kelly formula: An investor begins with $1 and invests a fraction (k) of the portfolio in an investment with two The Kelly criterion is concerned with economic choices. It tells us which course of action we should pick. If we want to maximise something

Even Kelly supporters usually argue for fractional Kelly betting a fixed fraction of the amount recommended by Kelly for a variety of practical reasons, such as wishing to reduce volatility, or protecting against non-deterministic errors in their advantage edge calculations.

When a gambler overestimates their true probability of winning, the criterion value calculated will diverge from the optimal, increasing the risk of ruin. Kelly formula can be thought as 'time diversification', which is taking equal risk during different sequential time periods as opposed to taking equal risk in different assets for asset diversification.

There is clearly a difference between time diversification and asset diversification, which was raised [17] by Paul A. There is also a difference between ensemble-averaging utility calculation and time-averaging Kelly multi-period betting over a single time path in real life.

The debate was renewed by envoking ergodicity breaking. A rigorous and general proof can be found in Kelly's original paper [1] or in some of the other references listed below. Some corrections have been published.

The resulting wealth will be:. The ordering of the wins and losses does not affect the resulting wealth. After the same series of wins and losses as the Kelly bettor, they will have:. but the proportion of winning bets will eventually converge to:. according to the weak law of large numbers.

This illustrates that Kelly has both a deterministic and a stochastic component. If one knows K and N and wishes to pick a constant fraction of wealth to bet each time otherwise one could cheat and, for example, bet zero after the K th win knowing that the rest of the bets will lose , one will end up with the most money if one bets:.

each time. The heuristic proof for the general case proceeds as follows. Edward O. Thorp provided a more detailed discussion of this formula for the general case. In practice, this is a matter of playing the same game over and over, where the probability of winning and the payoff odds are always the same.

Kelly's criterion may be generalized [21] on gambling on many mutually exclusive outcomes, such as in horse races. Suppose there are several mutually exclusive outcomes. The algorithm for the optimal set of outcomes consists of four steps: [21]. One may prove [21] that. where the right hand-side is the reserve rate [ clarification needed ].

The binary growth exponent is. In this case it must be that. The second-order Taylor polynomial can be used as a good approximation of the main criterion.

Primarily, it is useful for stock investment, where the fraction devoted to investment is based on simple characteristics that can be easily estimated from existing historical data — expected value and variance.

This approximation leads to results that are robust and offer similar results as the original criterion. For single assets stock, index fund, etc. Taking expectations of the logarithm:. Thorp [9] arrived at the same result but through a different derivation.

Confusing this is a common mistake made by websites and articles talking about the Kelly Criterion. Available online. We need to account for the compounding effects of loss when evaluating alternative courses of action.

How serious a loss is depends on how much money we have right now. Choose the course of action that maximises the geometric expectation of our total amount of the thing. In the presence of compounding, big losses are more serious than they seem at face value, and we account for that using the geometric expectation of our total amount of the thing.

This is all there is to the Kelly criterion. The rest is commentary. As we can see from the above, the Kelly criterion is more of a mathematical fact than a betting strategy.

The Kelly criterion tells us which, out of a set of alternative courses of action, will lead to most money in the long run. If someone working with money claims they do not use the Kelly criterion, there are effectively two possibilities:.

Anyone who does that are using the Kelly criterion under some name, because the Kelly criterion is literally that thing that maximises money in the long run.

There is no other thing that does that. Caius has purchased goods in Amsterdam which could be sold for 10, rubles in Petersburg, and thus has loaded them on a ship bound there.

The fair price for the shipment insurance would be rubles, but that would leave the insurer no profit. If Caius has fewer than 5, rubles, aside from the cargo of 10,, he should insure the shipment. Now here comes the interesting bit. This happens when.

The insurer must have more than 14, rubles to offer the insurance at rubles. If we imagine that Caius had 3, rubles, and the insurer 20, rubles — note what happens. When viewed through the Kelly lens, both insurer and insured profited from the exchange.

This is what makes insurance powerful. But we need to know about the Kelly criterion to evaluate it properly. The intuition behind this is that the arithmetic expectation is what we get if we are able to make the same bet over and over again, many times.

For small amounts, we can, and we should. Like any much loved child, the Kelly criterion has many names. What this really means is that in our car scenario, instead of evaluating. In terms of trying to optimise growth, these two will give equivalent results.

The latter is a plain arithmetic expectation, but not of the wealth — instead, of the logarithm of the wealth. If we denote the wealth by X, the expression stands for E log X. To maximise something which grows geometrically, choose the course of action that maximises the expected log-wealth of the thing.

The intution here is that the logarithm actually stands for growth rate. We have seen the Kelly criterion in a situation where we are considering whether to do something or not do it, like with the preventative repair.

This is a nice situation in that one of the courses of action leads to a guaranteed amount of wealth. Maybe our department budget allow us to invest into just one research project, but we have two promising candidate projects lined up.

In this scenario, imagine we need to invest everything into one of two projects. Here are the potential payoffs of the first project:. This is a risky project that will most likely end up just bleeding away half our budget. The middle outcome though, is doubling our investment.

This is a kind of boring project. It will never do better than double our investment. Which project should we go for? However, I did find that expected return was a good predictor of portfolio position size example below.

We have 3 potential investments with which to build our portfolio. But the Expected Return for Investment 3 is higher than 1 and 2.

This certainly seemed to point in the right direction but it still did not feel right to have them so closely sized. I decided that the ultimate method would be to skip the calculation of individual bets and calculate which bets would maximize the expected return of the portfolio Uncorrelated Portfolio bet size in chart.

This array of bets is how I came to the conclusion that the original Expected Return was a great predictor of portfolio position size.

Correlation in Trial 1. But then I thought about the Central Limit Theorem and I realized that diversification makes a difference when assets are uncorrelated.

But what if they are correlated? The benefit surely must be reduced. This tells me that the correlation inside the array of outcomes has a large bearing on position size. What I needed to do is ensure that each array properly matches the inter-correlation amongst assets in the portfolio.

At this point, I'm still working on that issue but maybe a starting point is the historical correlation and beta of each asset to the portfolio and other assets.

Next, build thousands of hypothetical arrays of returns for each asset based on the scenario analysis. Finally, pick the set of hypothetical arrays that is most closely aligned with the inter-correlation of assets.

From there we can iterate position sizes or use an optimization function that finds the portfolio with the maximum CAGR. Speaking of maximum CAGR, see how both portfolios have higher Portfolio CAGR Learn how Alpha Theory's platform provides investment teams with a framework to make investment decisions that drive performance.

Request a Demo. External Articles. Jan 31, This strategy creates a basket of attractive investments that should profit regardless of which investments in the basket succeed. This method benefits from simplicity and recognizes the future is inherently uncertain.

Drawbacks of the strategy include underweighting exceptional investments and overweighting marginal ideas. This methodology suggests investors should invest proportionally according to their ex-ante return expectations.

The advantage of this methodology is matching prospective return to investment size.

ich beglückwünsche, dieser Gedanke fällt gerade übrigens